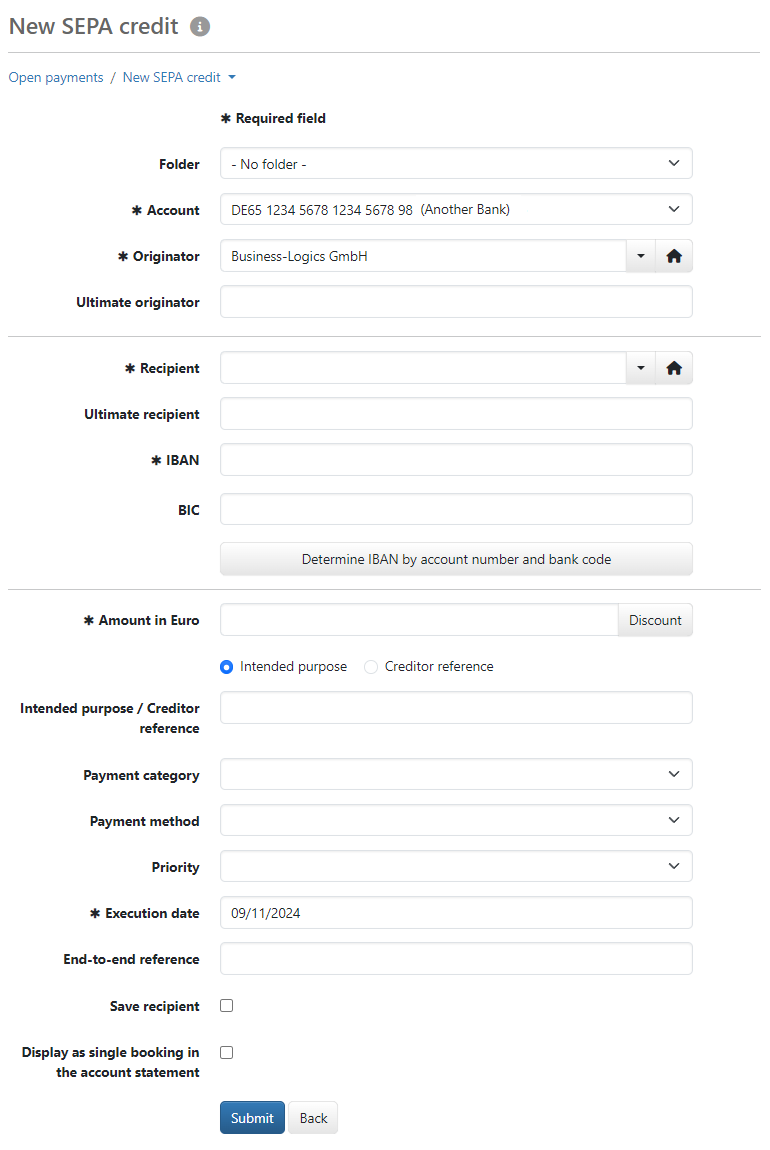

Figure: Form for entering a SEPA transfer

This page is almost identical for the payment types SEPA transfer, SEPA express payment and SEPA instant payment, except that the order type CCU is used for express payments and CIP for instant payments. You can obtain information about permissions and lead times from your bank. The fields for an alternative originator and recipient are not available in the express payment, as well as most of the values for payment category and payment type.

In this drop-down list, you can see the accounts that you can use as the originator in the payment. These are usually the same accounts that you can see in the overview Accounts. It is possible that fewer accounts can be selected here for the following reasons: The account settings are missing information that is necessary for this payment type, e.g. an IBAN for a SEPA payment, or you as a subscriber do not have permission for the account or the order type at the bank. Permissions from the user profile are displayed in the bank settings, see Bank settings – User profile – Permissions. Payment recording is still possible if an administrator or manager grants internal permission for the account in the account settings or user administration.

Here you can enter the originator or select one that has already been recorded.

Here you can enter the name of the actual record originator for the payment, e.g. if it does not match the name of the account holder. This field is not available with the express payment.

Here you can select already recorded recipients from the drop-down list, which opens by clicking on the arrow to the right of the input field. You can also enter a new recipient, but only if Recipient recording is permitted in the system settings under Payment recording. In your personal user settings you can set the maximum number of recipients to be displayed in the list.

As is the case with the ultimate originator, you can also enter the name of the actual payment recipient here. This field is not available with the express payment.

The IBAN (International Bank Account Number) consists of a two character country code, e.g. DE or FR, followed by a two digit check-number and an up to 30-digit account identification, consisting of digits and the uppercase letters A-Z. In Germany, this is the combination of the 8-digit bank code and the 10-digit account number.

The BIC (Bank Identifier Code) consists of a 4-digit master, which generally refers to the bank, followed by a two digit country code, a two digit filing number, and finally by a 3-digit branch office code or XXX for the national headquarters. The XXX can also be omitted.

In this field, autocompletion is available for the entry. This is described in chapter General - User interface - Detail pages.

The fields IBAN and BIC can only be edited if Recipient recording is allowed in the system settings under Payment recording.

The BIC is mandatory for cross-border payments outside of the EU/EEA area.

As soon as you have entered a valid value for the IBAN or BIC, the name of the bank will appear in this read-only field. Clicking on the button below opens a dialog box in which you can enter a German account number and bank code (Bankleitzahl). The functions verification, auto-complete, and bank name display are also available for this purpose. After confirming the data entry, the IBAN and BIC are displayed in the corresponding fields.

The conversion is carried out according to the complete rules of the German Bundesbank for the determination of IBAN and BIC from the account number and the bank code for the German payment area. In particular, the specifications for the check digit calculation of account numbers are taken into account. As the data basis, the program uses the current Bundesbank bank code file. Thus, deletions and changes to bank sort codes are also included in the conversion.

Enter the amount in Euro here. Via the Discount button a dialog window is displayed, which lets you enter a discount value in percent. After that the new amount is calculated and displayed. Furthermore an entry about the discount is added to the field Intended purpose.

With the radio button above this field you can choose whether to enter an intended purpose or a payment reference. With the intended purpose you can describe the reason for the payment in an unstructured way with up to 140 characters. The payment reference may contain up to 35 characters and is used for a structured specification, e.g. according to ISO 11649.

Select a payment category from this drop-down list. This list is gathered from the ISO 20022 standard.

This field corresponds to the text key, known from the German DTAUS payment, and is used to indicate the reason of a SEPA payment. The selected value is usually transmitted to the receiving bank and their final recipients and could possibly appear in the account statement. As with the Payment category this list is gathered from the ISO 20022 standard.

In the case of the express payment, only the values CORT and INTC are available for these fields.

Here you can set the priority of the payment execution to Normal or High. If there is no agreement with the respective bank in this regard, the value Normal will be assumed. Please contact your bank for possible applications.

Enter the date here, when the payment shall be executed. If you create several payments with different execution dates and then sign them together, you will see these payments listed individually in the accompanying ticket.

Enter a reference number here. This will be forwarded to the owner of the receiving account.

If this checkbox is set, the entered receiver is saved, unless it has been selected from the drop-down list and has not been changed after that.

Principally banks provide payments from a SEPA file only combined as a batched transaction in the account statement. If you want to see this payment as a separate transaction in the account statement, please activate the checkbox.

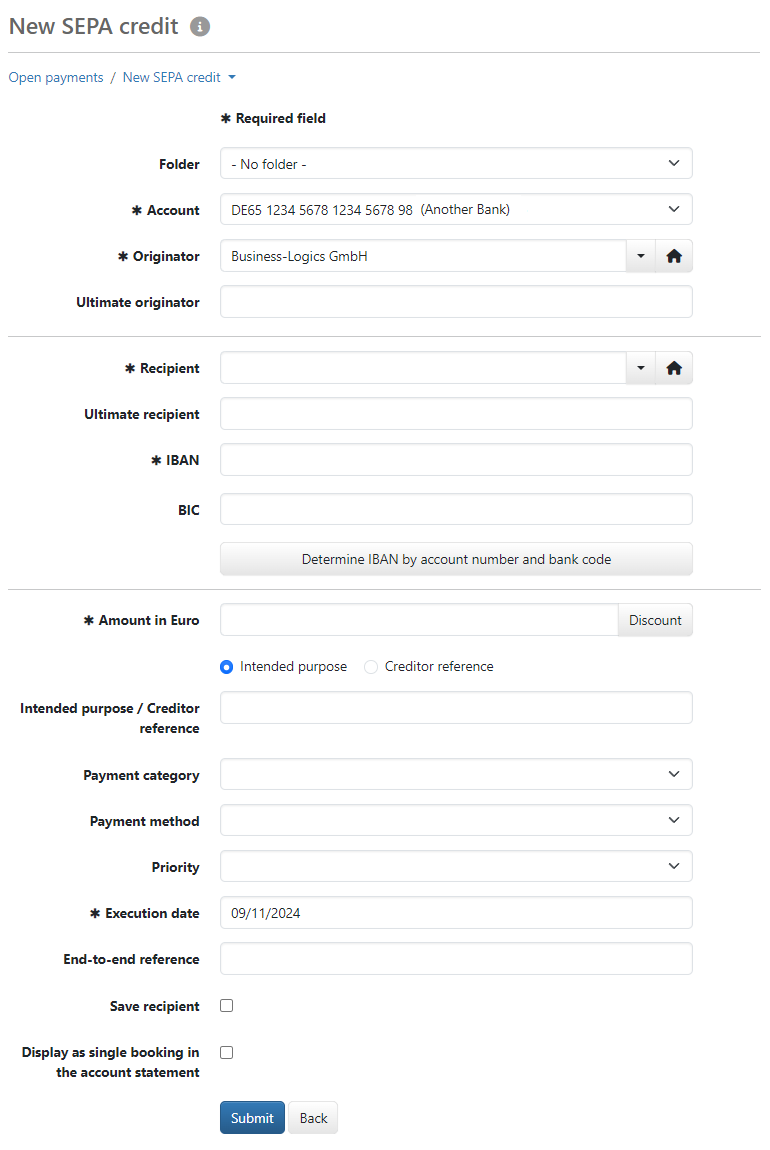

Figure: Form for entering a SEPA transfer