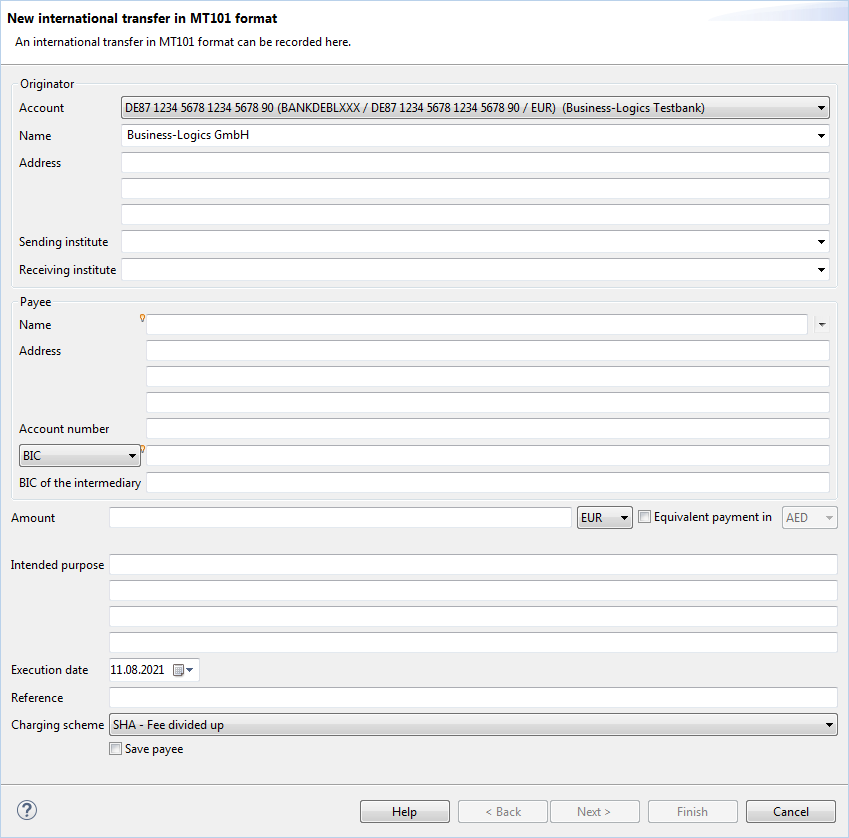

Figure: Dialog box for entering an international transfer

With the international transfer you can make a payment from a remote account, which you cannot access directly. This may be necessary, for example, if the recipient of the payment is located outside the SEPA area. To do so, the payment is sent in the MT101 format via SWIFT to another bank, which transfers it to the recipient and debits your remote account. In order to use the international bank transfer, your bank must grant you authorization for the order type RFT.

Up to five banks are involved in an international transfer (no. 1 to 3 on the originator's, 4 and 5 on the receiver's side). The procedure could look like this:

From this drop-down list, select your account at the remote bank (see above no. 3). You must first create this account under Accounts.

This drop-down list contains the MT101 originators that are available in the overview Originators. However, you can also enter a different name here.

If the address data had already been entered in the above selected originator, these are used here. Otherwise, you can also enter the address manually here.

Enter here the BIC of your bank, to which you are directly connected via EBICS (see above no. 1).

Enter here the BIC of the bank, to which the payment is sent by SWIFT (see above no. 2).

Enter the data of the beneficiary here, i.e. the recipient of the transfer.

With this drop-down list, you can either set BIC or Sort code, and accordingly enter the identification of the recipient bank in the text field next to it.

If required, you can enter the BIC of an intermediary bank here (see above no. 4).

Here you can enter the amount in any currency. If you choose a currency other than Euro, the value in Euro is displayed below the field. This value is non-binding and the conversion is not possible for all currencies.

By ticking the checkbox you can issue an equivalent value payment, i.e. you enter an amount, for example, in Euros, which the recipient receives in the currency that you selected from the drop-down list to the right of the field. Here too, the equivalent value is shown in the line below if available.

The ECB issues the ECB rates daily at 2:15 p.m. Before this time, only the previous day's rate is available.

The indicated rates are average rates and exclusively used to determine whether a Z1 report of the payment needs to the provided to the Bundesbank and to determine an approximate value for the debit charged to your current account. Trades are not performed at the average rate - the buy and sell rates deviate up or down from this.

You are generally charged the bid price when your payment orders are settled.

Since banks conduct their own currency trades, and can therefore also charge their own rates (which may deviate from the ECB rate), you should discuss the actually charged rate with your bank.

Here, you have four fields with up to 35 characters each available, which can be used to describe the purpose of the payment in greater detail.

Enter the date on which the payment needs to be executed.

Enter a reference number here, which will be forwarded to the owner of the receiving account.

Here, you can determine who will pay the fees for the international payment.

If this checkbox is set, the entered receiver is saved, unless it has been selected from the drop-down list and has not been changed after that.

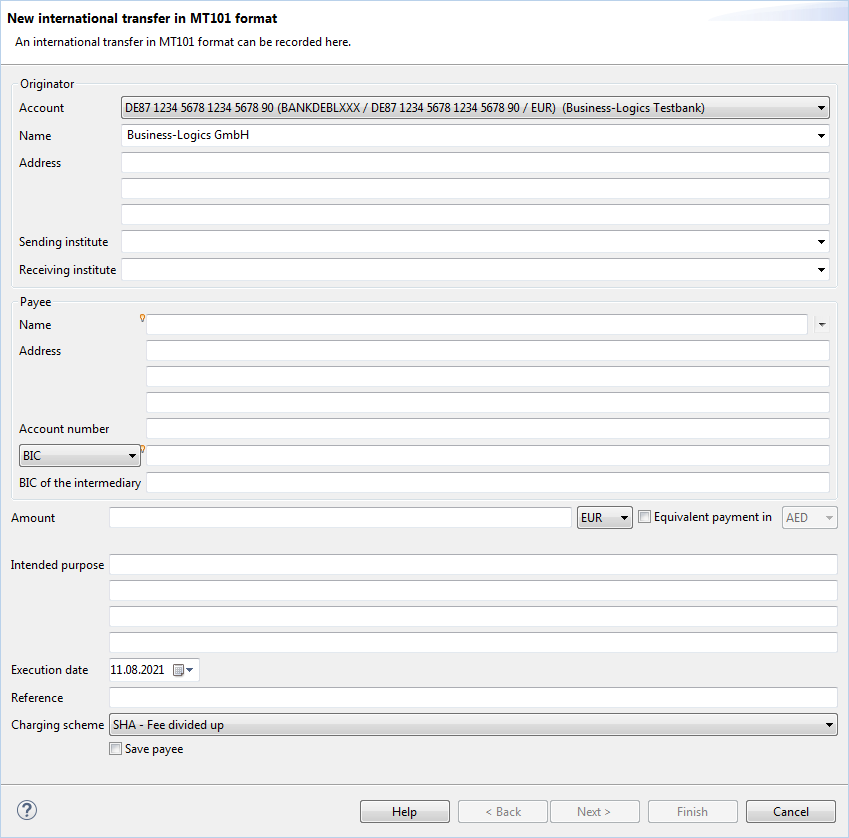

Figure: Dialog box for entering an international transfer

Click on Next to get to the next step of the wizard.