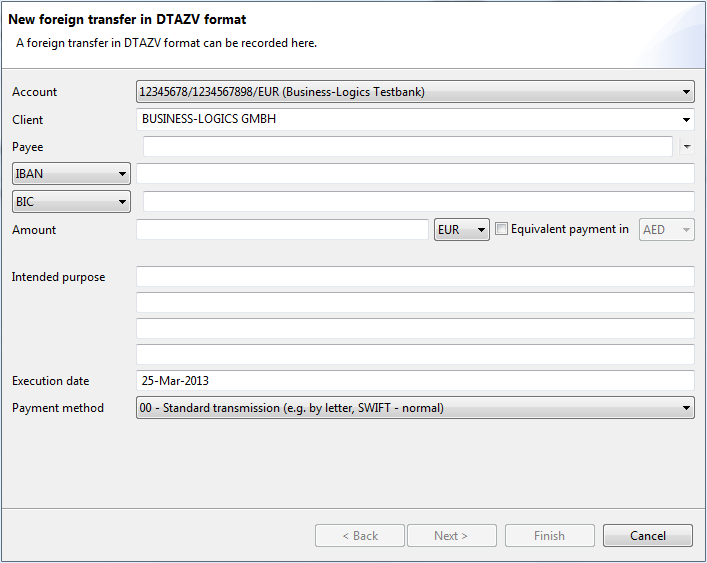

Figure: Dialog box for entering an international transfer

A foreign transfer is the classic form of payment across national borders beyond Europe or for a payment in a foreign currency. The processing format is DTAZV.

Because of the large number of fields, a wizard with several dialog boxes is available for data entry.

This dropdown list displays all the accounts that you as the client can use for this payment. In most cases, these are the same accounts that are displayed in the Accounts overview. However, it is possible that this list contains fewer accounts, for example, if you as a bank user do not have authorization for an account or an order type, or if for an account, details about the bank connection required for this payment type are missing.

You enter this name when first using the feature and is generally the account name. This entry is stored for future use and is displayed in the Originators tab.

You can enter the recipient here, who is then also stored for use in future electronic funds transfers.

The IBAN is not mandatory for this payment if you are entering payments to countries that are not EU members. In this case, select Account number from the drop-down list on the left and enter here the national account number of the recipient.

Please enter the BIC of the payee's bank here. This is the same as the SWIFT address. If you don't know the BIC, you can leave this field empty and instead enter name and address of the bank on the following pages of this wizard. If you know a national number of the payee's bank instead of the BIC, select Sort code from the drop-down list on the left and enter this number here. By the same way you can also enter the German bank code for payments in foreign currency within Germany.

Enter the desired amount for the payment currency here. Then select the payment currency from the drop-down list to the right of the field. BL Banking automatically displays the corresponding value in EUR, provided the average exchange for this currency is listed in the daily fixing of the European Central Bank (ECB). The rates are automatically updated upon each application start. This requires an Internet connection.

This checkbox is only active when EUR is selected as the currency to the right of the field. You can then issue an equivalent value payment, i.e. you enter an amount in Euros, which the recipient receives in the currency that you selected from the drop-down list to the right of the field. Here too, the equivalent value is shown in the field below if available.

The ECB issues the ECB rates daily at 2:15 p.m. Before this time, only the previous day's rate is available.

The indicated rates are average rates and exclusively used to determine whether a Z1 report of the payment needs to the provided to the Bundesbank and to determine an approximate value for the debit charged to your current account. Trades are not performed at the average rate - the buy and sell rates deviate up or down from this.

You are generally charged the bid price when your payment orders are settled.

Since banks conduct their own currency trades, and can therefore also charge their own rates (which may deviate from the ECB rate), you should discuss the actually charged rate with your bank.

Here, you have four fields with up to 35 characters available to describe the purpose of the payment in greater detail.

Please note that you generally need to submit foreign currency payment orders to your bank two days before the execution date. The bank needs this advance notice to obtain the required currency on the currency market.

You can select from the following payment type as instructions for your bank:

Annotation for check payment: In this case, the check can either be sent to the beneficiary (20-23) of the payment, or to you as the originator (30-33). With the different sending methods, you can determine whether the letter is sent by standard mail, registered mail by courier, or courier only.

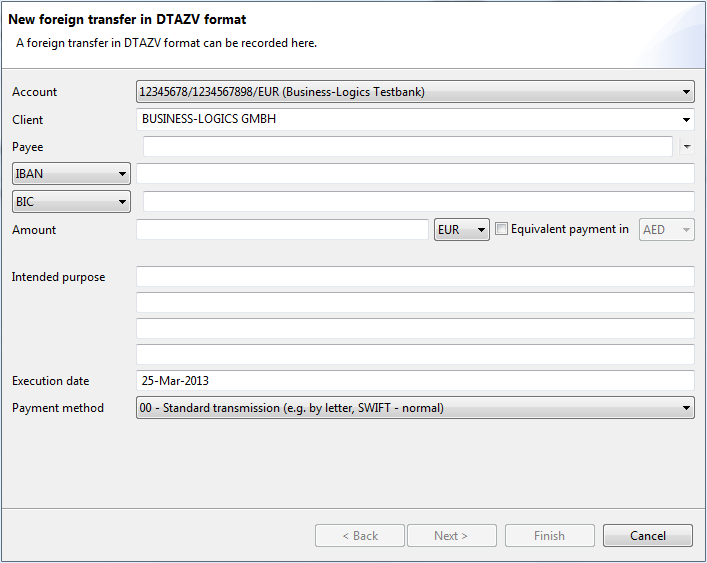

Figure: Dialog box for entering an international transfer

Click on Next to get to the next step of the wizard.