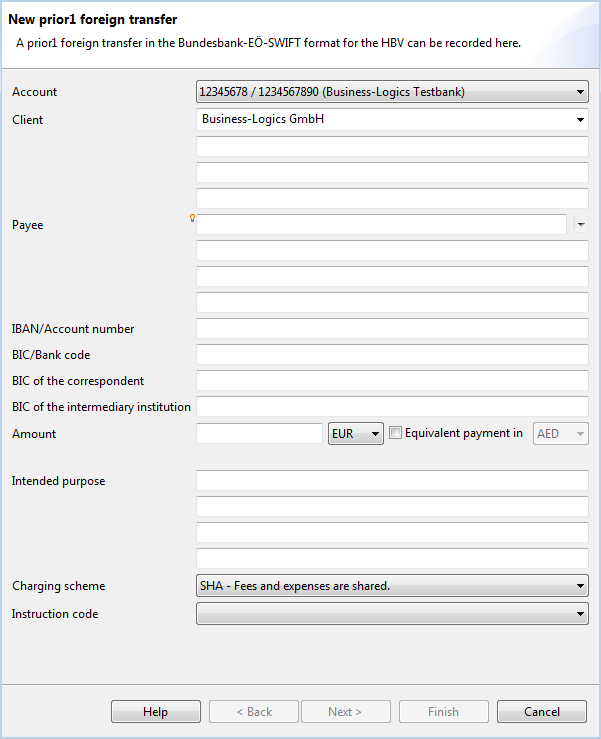

Figure: Dialog box for entering a Prior1 foreign transfer

A Prior1 foreign transfer in the Bundesbank-EÖ-SWIFT format for the HBV can be recorded here.

This dropdown list displays all the accounts that you as the client can use for this payment. In most cases, these are the same accounts that are displayed in the Accounts overview. However, it is possible that this list contains fewer accounts, for example, if you as a bank user do not have authorization for an account or an order type, or if for an account, details about the bank connection required for this payment type are missing.

During first use, you enter the name, which is generally the account name of the account. This entry is stored for future use and displayed in the Originator tab.

Here you can enter the name and, if necessary, the address of the recipient who is then also stored and can be reused for future electronic funds transfers.

This field is also equipped with data entry support functionality, as described in chapter User interface - Dialog box - Auto complete. In addition, you can also select already entered recipients from the drop-down list, which opens to the right of the data entry field by clicking on the arrow

You can set the maximum number of recipients shown in the list in the preferences under Payment recording. If you have multiple recipients, a window with a corresponding message is displayed in place of the list. However, you can continue to use the auto-complete function in this case.

Please enter the IBAN or account number of the recipient here.

Please enter the BIC of the payee's bank here. This is the same as the SWIFT address. If you don't know the BIC, you can leave this field empty and instead specify the address of the bank on the following page of this wizard. If you know a national number of the payee's bank instead of the BIC, you can enter it, too.

Here you can enter the BIC of the correspondent and the intermediary institution. If you do not know this, you can leave these fields empty and instead specify the addresses on the following page of this wizard.

Enter the desired amount for the payment currency here. Then select the payment currency from the drop-down list to the right of the field. BL Banking automatically displays the corresponding value in EUR, provided the average exchange for this currency is listed in the daily fixing of the European Central Bank (ECB). The rates are automatically updated upon each application start. This requires an Internet connection.

This checkbox is only active when EUR is selected as the currency to the right of the field. You can then issue an equivalent value payment, e.g. you enter an amount in Euros which the recipient receives in the currency that you selected from the drop-down list to the right of the field. Here as well, the equivalent value is shown below if available.

The ECB issues the ECB rates daily at 2:15 p.m. Before this time, only the previous day's rate is available.

The indicated rates are average rates and exclusively used to determine whether a Z1 report of the payment needs to the provided to the Bundesbank and to determine an approximate value for the debit charged to your current account. Trades are not performed at the average rate - the buy and sell rates deviate up or down from this.

You are generally charged the bid price when your payment orders are settled.

Since banks conduct their own currency trades, and can therefore also charge their own rates (which may deviate from the ECB rate), you should discuss the actually charged rate with your bank.

Here, you have four fields with up to 35 characters available to describe the purpose of the payment in greater detail.

Here, you can determine who will pay the fees for the international payment.

Since the SHA arrangement only results in charges that the respective banks have agreed with their customers, the fees are predictable and known in advance.

If you choose the code CHQB here, the recipient will be issued a cheque. The BIC/Bank code field will then be filled with a value, which depends on the selected currency. Furthermore, the fields BIC/Bank code and IBAN/Account number are deactivated and you have to enter the address of the recipient. If EUR was selected as the currency for the amount, a equivalent value payment is activated. The available currencies and the corresponding BICs are stored in the text file SwiftToCheque.properties, which is located in the subdirectory payments in the workspace. You can add currencies to this file yourself. You can open the workspace directory from the main menu item Help. See chapter General - General functions - Help.

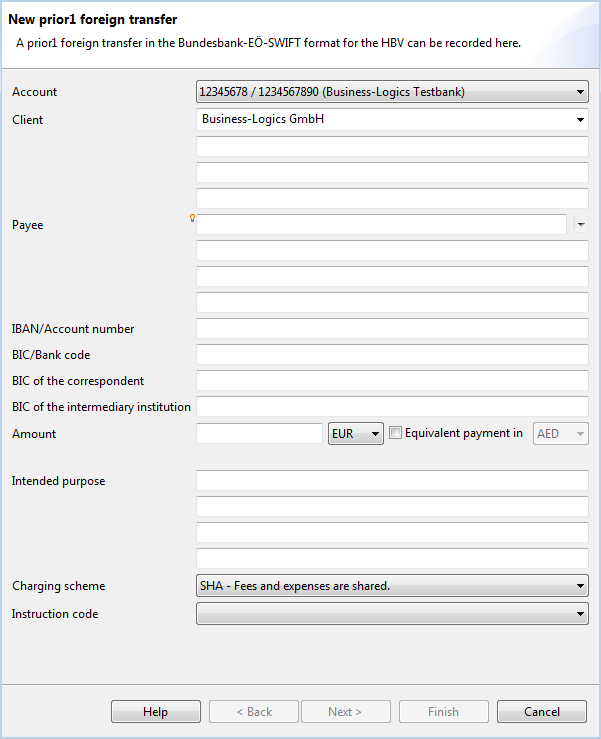

Figure: Dialog box for entering a Prior1 foreign transfer

Click on Next to get to the next step of the wizard.