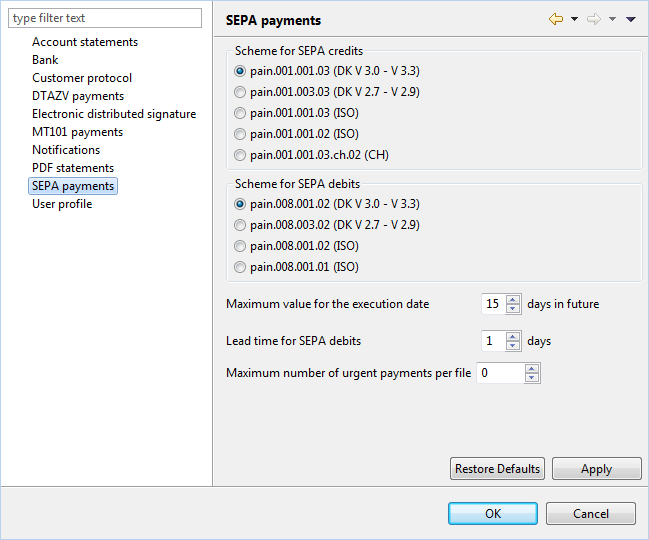

Figure: Settings for SEPA payments

This setting applies to SEPA transfers and instant transfers. The checkbox is activated by default so that the bank initiates a verification of payee (VOP) before accepting the payment order. Only deactivate the checkbox if the bank does not process any orders with verification of payee or if the verification of payee is temporarily suspended.

This checkbox can only be edited if the verification of payee is activated. This controls whether there should also be an option for individual payments (not compliant with the rules). Only deactivate this checkbox if you have an agreement with the bank. If you submit a single payment without verification of payee without an agreement, the EBICS bank server will reject the order.

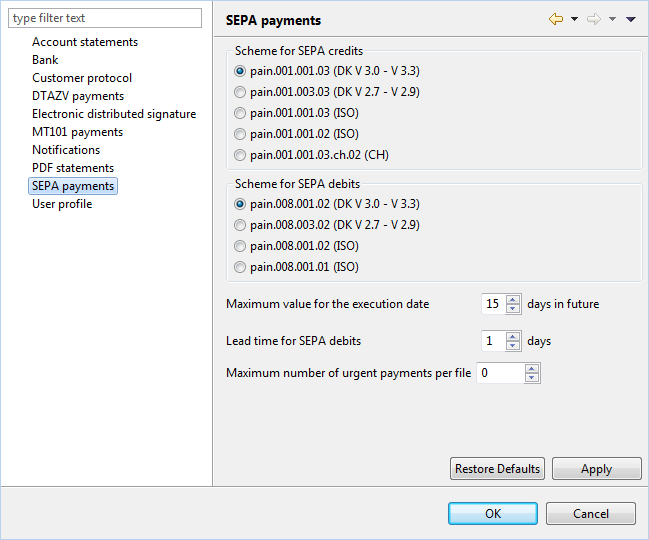

Some banks limit the execution date of a payment, i.e. it may only lie a certain time in the future. If you learn of such a restriction, you can set the number of days here that the execution date can lie in the future. If you then exceed the time during payment recording, an error will be reported and the date will be corrected.

Here you can set the lead time in days the bank of a creditor needs to transfer a SEPA debit to the bank of the debtor. This is used together with the execution time cycle to validate the payment date when recording a debit.

Some banks only allow a certain number of express payments in one order. If the value you set here is exceeded during signing multiple open payments or while directly transferring a file, the payments are distributed over multiple orders. These are visible in the accompanying ticket. When directly transferring, additionally a message is displayed before signing. The default value of 0 means there is no restriction.

Figure: Settings for SEPA payments