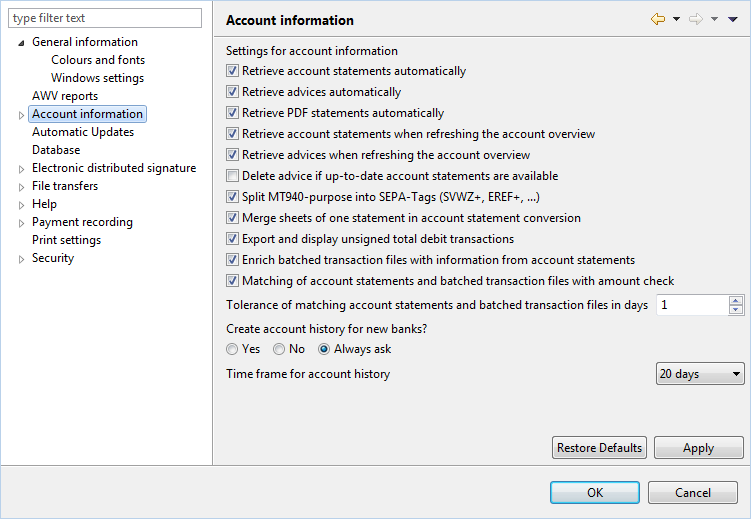

Figure: Preferences - Account information

Here, you can determine how the electronic account statements provided by the banks will be handled. The descriptions for the checkboxes always refer to the activated state.

As soon as the view Account overview is called up for the first time after the program start, the account information selected with the checkboxes is automatically retrieved from the banks. If data shall be retrieved again during a program session after changing the view, this must be triggered with the Refresh function.

If you update the account overview, account statements or advices are retrieved from the banks. If the checkbox is not set, only the changes made by another user in a multi-user installation are displayed.

Since advices are basically outdated when the regular account statements arrive, the advices can also be automatically deleted. You can define this here. You can of course also delete each advice manually.

For account statements in MT940 format, information from SEPA payments are stored structured in the field Intended purpose using SEPA tags. Thus, such information, e.g. the End-to-end reference (EREF +), can be made visible in the posting details.

Statement pages are ignored and all statement data is output in a single section under a single statement number.

The negative sign in the fields Total debit transactions, Largest debit transaction and Smallest debit transaction is not displayed when viewing, printing or exporting account statements.

The batched transaction files are expanded with data from the account statements that are not shown in the batched transaction files themselves, e.g. the value date for a transaction.

In certain cases it can happen that the match neither will succeed via reference numbers nor via the time restriction described below. Then an additional adjustment via the amount of the batched transaction can be applied. This setting has priority over the matching with days.

A data adjustment between account statements and batched transaction files is performed based on matching reference numbers. These can however occur multiple times. For this reason, a time window is defined, which is set here.

The default value for the retrieval period of historical account statements is defined here.

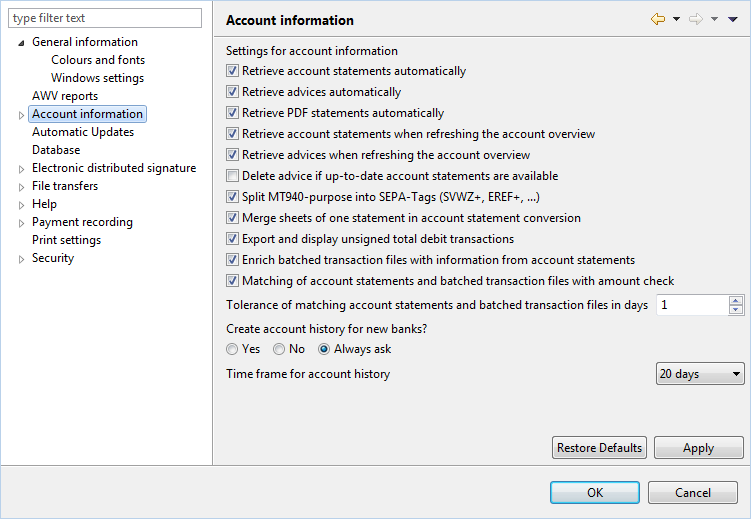

Figure: Preferences - Account information