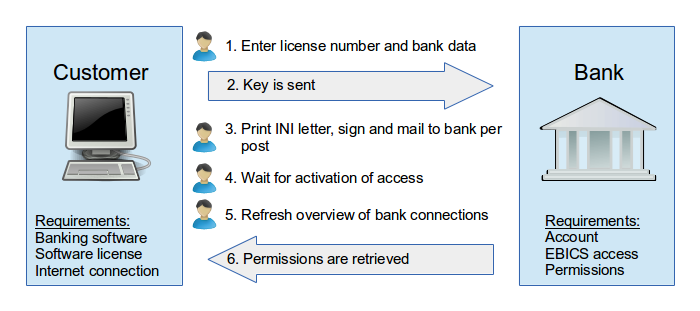

Figure: Set up EBICS access

The Electronic Banking Internet Communication Standard (EBICS) is a method for the secure transmission of payments over the Internet. Both the technical details of the data transfer, as well as the particulars regarding permissions and order types are standardized in EBICS.

The following introduction illustrates some of the basic use cases, whereby the separation in customer and bank side are considered. The activities, which need to be performed by the user, are marked with a user symbol, whereas the communication with the bank, displayed by arrows, is executed by the program.

To be able to use EBICS, you need a computer with Internet access and a software program, which supports the EBICS standard, e.g. BL Banking. You can purchase a license for this software from Business-Logics.

From your bank you need an account and EBICS access. Your bank configures the permissions for the account, the order types and the signatures according to your requirements. Before you can initialize, the bank must set the state of your EBICS access to "NEW".

During the initialization you need to enter the license number and the access data, which you received from the bank. After that BL Banking generates a key and sends it to the bank. To ensure that the key really came from you, you additionally must mail it on paper to the bank, which will activate your EBICS access after the verification succeeded. BL Banking will then retrieve your permissions and is ready to be used.

Figure: Set up EBICS access

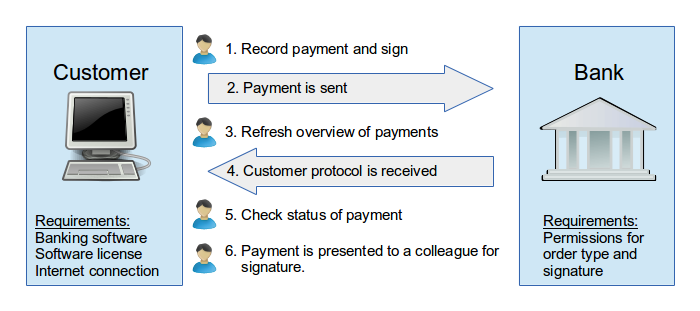

To submit a payment to the bank, you first need to record or import it. After you have signed the payment, it is sent to the bank by BL Banking. When you then refresh the overview of the payments, the customer protocol is retrieved from the bank and the status of the order is updated. If another signature is required to complete the transaction at the bank, this is then available at a user with signature authorization.

Figure: Submit payment

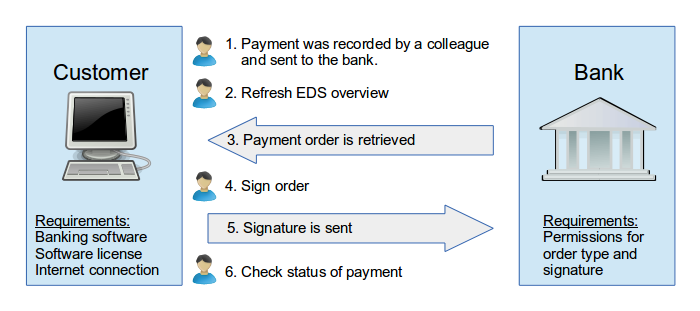

The payment you signed and sent to the bank, still must be signed by another user, so it can be processed by the bank. This he can do from his own computer or also from a different location. After refreshing the overview of the electronic distributed signature (EDS) the payment order is retrieved from the bank, displayed and can be signed. After the signature was sent to the bank, you can again retrieve the customer protocol from the bank by refreshing the overview and see the updated status of the order.

Figure: Sign order