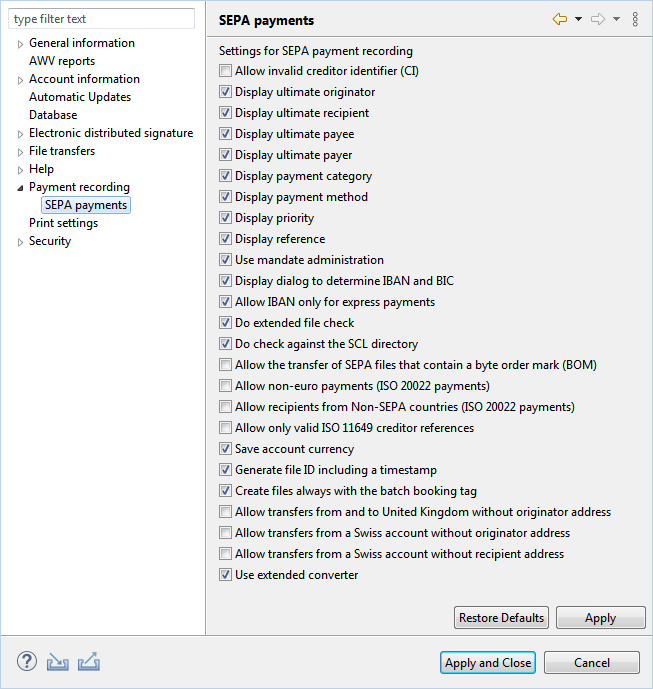

Figure: Preferences - SEPA payments

The creditor-ID has a certain format and a maximum length, which are verified during entry. By activating the checkbox the verification is disabled.

You can set whether the following eight fields are displayed during recording SEPA payments.

• Ultimate originator, ~ recipient, ~ payee, ~ payer

• Payment category, Payment method

• Priority, Reference

Here you can switch the mandate administration on or off.

If this checkbox is set, the Button Via account no. and sort code is displayed during recording a SEPA payment.

Since the BIC of the recipient or payer is not mandatory throughout the SEPA area, SEPA transfers and SEPA debits can be entered and sent without a BIC. With this setting, this also applies for SEPA express payments.

With activated checkbox, additional checks are performed, when sending SEPA files, including checking for invalid characters. If an intended purpose contains an exclamation mark, for example, an error message appears and the file cannot be sent. Furthermore, it is checked that for SEPA express payments a BIC is specified for the recipient.

The SCL directory is used for the automated processing of SEPA payments via the SEPA clearer of the Bundesbank. When recording SEPA payments, it is checked whether the entered BIC is included in the SCL directory and thus can be reached via the SEPA clearer. If you use other BICs, you can switch off this check here.

According to the specification of data formats of the German Banking Industry Committee, SEPA files with byte order mark are not allowed. However, some customers use payment files with BOM, which for example, they export from their ERP system. With the setting here you can allow such files to be sent to the bank. However, this does not guarantee that the banks will accept these files.

By setting this checkbox it is possible to submit SEPA payments in currencies other than Euro. These do not correspond to the specifications of the Deutsche Kreditwirtschaft, but conform to the ISO 20022 standard.

With this checkbox set, SEPA payments with recipients from outside the SEPA area can be recorded and submitted. As with the payments in foreign currency mentioned above, these are also compliant with the ISO 20022 standard.

Here you can set that only valid values according to ISO 11649 can be entered in the field Creditor reference.

By default, SEPA files contain a field with the account currency. If you uncheck the box, SEPA files will be created without this field. This is also visible in the accompanying ticket.

With this setting, a unique Message ID is generated for the SEPA file by adding a time stamp. This ID is visible in the accompanying ticket as File ID. If the checkbox is deactivated, only a counter generated by the program is used. However, under certain circumstances, this can lead to multiple submissions of payments with the same ID and thus rejection by the bank.

If this checkbox is not set, a marker (tag) for batch booking will only be created in the SEPA file if its value is False, i.e. the payments within a file are displayed as single bookings in the corresponding account statement. If the marker is missing, this is equivalent to the value True and thus will lead to a batched booking in the account statement. However, some banks require that a marker (batch booking tag) must always be present in the SEPA file, regardless of the value. This can be achieved by setting the checkbox.

For the countries Great Britain and Switzerland, it is required that the originator address or recipient address, respectively is specified for transfers. In some cases, however, these addresses are known to the bank and are added by the bank itself. In this case you can deactivate the three checkboxes and thus don't have to specify the address any longer.

When importing or sending an external payment file that is available in CSV or Excel format, a converter is used for the transfer to the SEPA format. There is a simple and an extended version, where the latter supports more fields. If you run into problems with this, you can remove the checkmark here and that way use the simple converter.

Figure: Preferences - SEPA payments